FIXER UPPER MYTHS & FACTS

What You Should Know BEFORE You Buy

Before deciding that your next home must be a fixer-upper, you should do some homework into what to expect when purchasing these types of homes. Many prospective homebuyers tend to have a romanticized version of the entire process, and are quite shocked when confronted with the hard reality.

Fixer Upper homes can often represent a good deal, but there are some points that a homebuyer should be aware of before making that offer.

MYTH #1 . . .

I can make a "killing" in the real estate market by buying a run-down home, for tens of thousands of dollars less than the average home, fixing it up, and then immediately selling it for full price, or more.

FACT #1 . . .

Most homeowners looking to sell their "fixer upper" home understand that they will have to list their home at a price that reflects the cost involved in restoring the home to its original condition. The asking price of a fixer upper is usually calculated so that the savings represented by the lower than average market price is roughly equal to the amount of money that a buyer could expect to spend on necessary renovations.

Updating the "look" of a home, or upgrading to higher-end finishes, is not included in these calculations, and you should be careful not to spend so much money on renovations that you are unable to recoup your investment.

MYTH #2 . . .

If I’m buying a fixer-upper home, I don’t need to bother with the added cost and aggravation of a home inspection because I already know what I’m getting.

FACT #2 . . .

A home inspection should always be included in an Offer To Purchase and Sell agreement, and it is arguably even more important to include one when you are looking to buy a fixer upper. Structural defects are normally not visible to the untrained eye, yet will cost much more to repair than the obvious cosmetic fix-ups. Most licensed home inspectors will not only detail the defects that they uncover, but can also give you a good idea of the costs involved in fixing them.

MYTH #3 . . .

It’s better to pay a lot less and buy a "fixer upper" in an undesirable area, than to pay more for a comparable "fixer upper" in a better neighborhood.

FACT #3 . . .

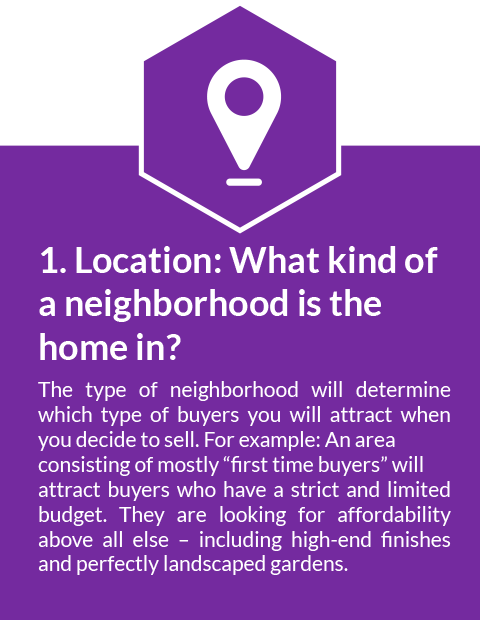

Most of us have heard the quote, "the three most important things to look for when buying a home are: location….location…and location!" While this is obviously meant to be funny, and is a somewhat oversimplified rule of home buying, it does drive home the point of how important it is to consider where you will buy your home. Purchasing a fixer upper in a desirable neighborhood will cost you more initially, but the payoffs -- personal peace-of-mind and higher return on your home investment when you sell -- should not be overlooked.

MYTH #4 . . .

Once I fix this house up, I can turn around and sell it for double the price I paid.

FACT #4 . . .

A home will only sell for what the market can bear. What this means is that no matter how many upgrades were made, or how much money has been invested in the upgrades, a home will only sell for what the majority of homebuyers are willing to pay.

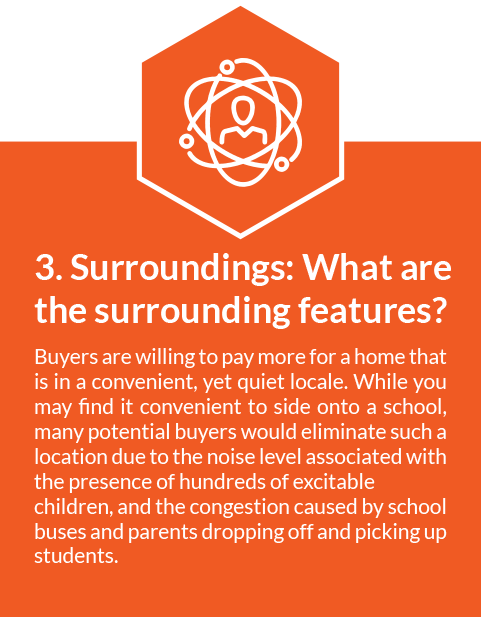

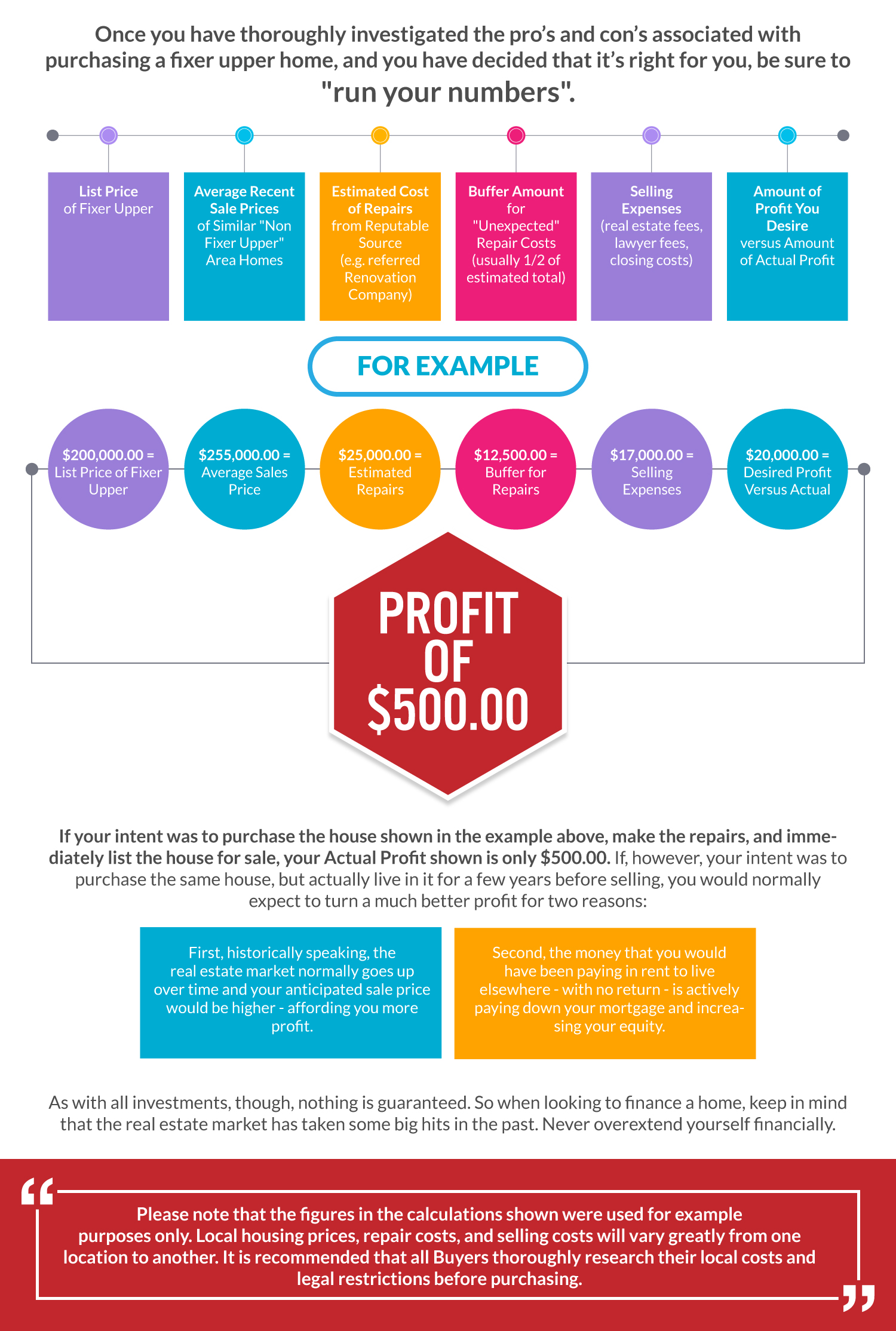

Factors to consider when calculating your possible return on investment:

MYTH #5 . . .

I can make a lot more money by turning this single family home into a multi-family dwelling.

FACT #5 . . .

While this statement is for the most part true, it may not be possible. Most towns and cities have strict zoning laws that not only dictate the maximum allowable occupancy within any given area, but also dictate the size and design of a home when building new, or creating additions to an existing structure.

Your Referrals Help Save Children From Cancer

if you have questions, please contact us:

Typically replies within 24 hours

Contact Us

You agree to receive property info, updates, and other resources via email, phone and/or text message. Your wireless carrier may impose charges for messages received.

You may withdraw consent anytime. We take your privacy seriously.